Easter Land Guides

G’day and welcome to our special James Report on the changing of Melbourne’s land values in early 2015 (updated from a few weeks ago).

We detail below:

- Melbourne’s Big Land Influences

- Melbourne’s Land Values

- Melbourne Land Opportunities

Melbourne’s Land Influences

Question: Which suburb in Melbourne is having the greatest influence on land values across all of Melbourne?

Is it Toorak, Brighton, Hawthorn or is it Albert Park?

These are very influential suburbs and more expensive than the suburb we think is Melbourne’s most influential land value suburb, but it is not any of these.

No, Melbourne’s Most Influential Land Suburb is

…….. drum roll please ……. Balwyn; and it has been since 2008 and possibly since the late 1990’s. What happens in Balwyn has been driving Melbourne land prices.

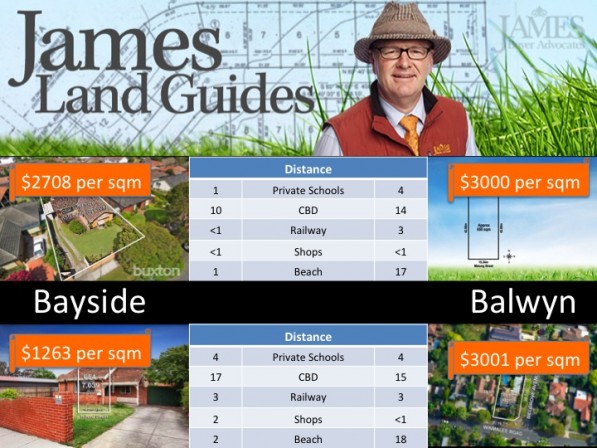

A-grade land in Balwyn at Easter 2015 is now firmly at $3000 per square metre. This is evidenced by multiple sales, including the auction we were at over the long weekend at 58 Metung Avenue, Balwyn (Pat Dennis).

Quick little auction report on 58 Metung:

The block is a marginally undersized block, in a ‘name’ street, in the Balwyn High school zone; but other than that, it is most unremarkable. West facing with an average frontage and a “no value” bulldozer home on it. Last weekend was a long weekend with only a few auctions. There were 80 people who felt compelled to rock up to participate in or watch this outcome. After a solid opening start at $1.8m from ourselves, we saw only four more bids from the three bidders. It was all over in a flash at $1,950,000 under the hammer. At 650 sqm in size, our maths says that it sold for exactly $3000 per square metre.

Supporting evidence of this is 5 Winmalee, Balwyn (Richard Winneke) which sold the week before at $3001 per sqm for a bulldozer 781 sqm home.

Both these addresses are almost North-Balwyn, not Canterbury-Balwyn.

In the last 7 years, Balwyn has been both the saviour and the devil for many Melburnian homebuyers.

Question: Why is Balwyn all powerful in terms of land value influences?

Answer: Overseas Chinese buyers value homes higher than local buyers and this has put pressure on overall prices. Overseas Chinese buyers have the wealth in numbers to back their valuations.

Yes, but why Balwyn?

- Schools for Chinese and other Asian children

- History – it’s close to earlier established Chinese communities in Box Hill and Doncaster

- Chinese people like new-build homes and Balwyn has fewer council restrictions to bulldoze than say Hawthorn

Balwyn (and Kew) saved Melbourne Property from the GFC in 2008

Balwyn and Kew were the leaders in GFC times, when the FIRB law changes opened the floodgates on the previously steady interest from Overseas Buyers. This massive increase in interest turned the struggling Melbourne GFC housing market into a hotbed of excitement. Read Our 2009 James Market News Archives.

Now in 2015, Balwyn is seen as a negative by local Australian buyers. The once welcome bidding from overseas, is still welcome by downsizing sellers; but it’s certainly no longer welcome by local buyers, as many have been forced out of the market.

Balwyn is affecting markets far wider than Balwyn itself.

Balwyn is now consistently more expensive than most of Bayside.

Yep that’s right, Balwyn is now more expensive than a lot of Hampton, than almost all of Sandringham and its line ball with a fair part of Brighton and Elwood.

Remember when Balwyn North and Beaumaris were comparable in dollar terms. There is now a vast chasm.

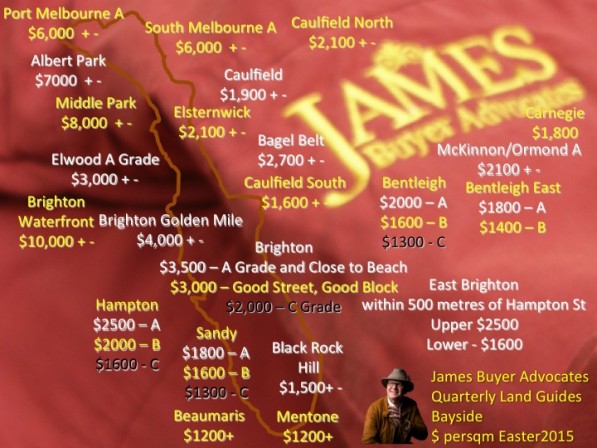

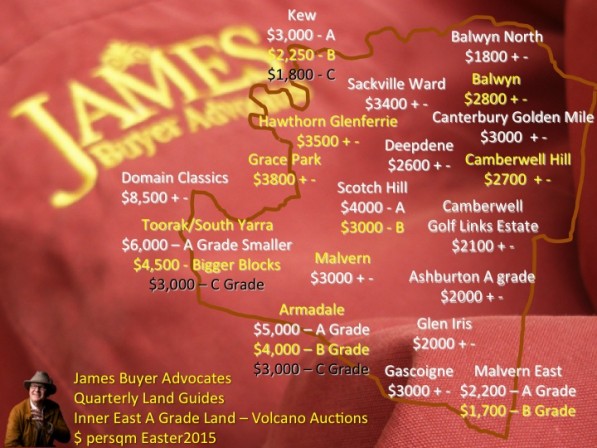

Below is part of our new updated land value data which is now current (Easter 2015).

About James Land Values Above:

- Please note these values represent an overview. They are guides.

- We have done a fair bit of rounding, so as to simplify the different and changing values in Melbourne land.

- Values change dramatically with:

+ Views

+ “Name Streets”

+ Wide Frontages

+ Auction Interest

– Main Road

– Irregular Block

– Weaker Precincts

– High Vendors

- There are some auction results that we consider are outliers, in that they appear to us to be under or over the market

- Some houses, eg ones that cannot be bulldozed are, in 2015, actually discounting the land value; such is the insatiable appetite by overseas buyers for land you can build on.

- These values, vary from street to street and in this market can change in a month or so eg before Christmas 2014 and after New Year 2015. If you are considering using a buyer advocate and would like an up to date report on the land and home values in your street, then please contact us on our mobiles or at our offices 9804 3133. The above are guides only to show comparisons and should not be relied on in specific instances without further professional due diligence.

Land Price Acceleration: Volcano Auction Prices (4+ Bidders) have risen 10% on bigger land – November 2014 to February 2015!

That’s right 10% or $200,000 on a $2 million block of land. Of course there are exceptions higher and lower.

This will have major flow on effects on new home prices in these areas in the months to come.

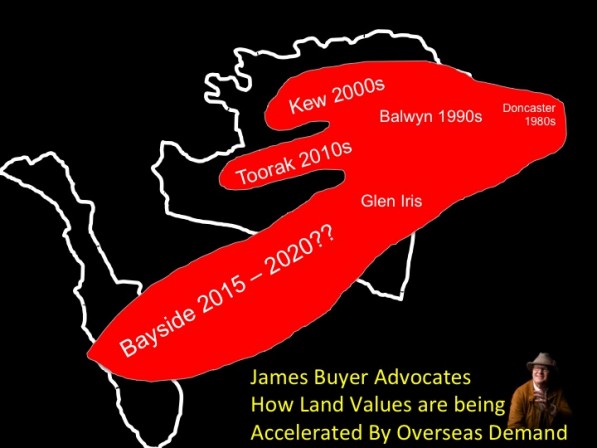

But really it’s no surprise to experienced and longer term market watchers. Below is a graphic of how land values have accelerated ahead of the pack since overseas buyers from Asia begun to buy land as far back as the late 1970’s.

With a herd mentality and ‘panic’ comes opportunity.

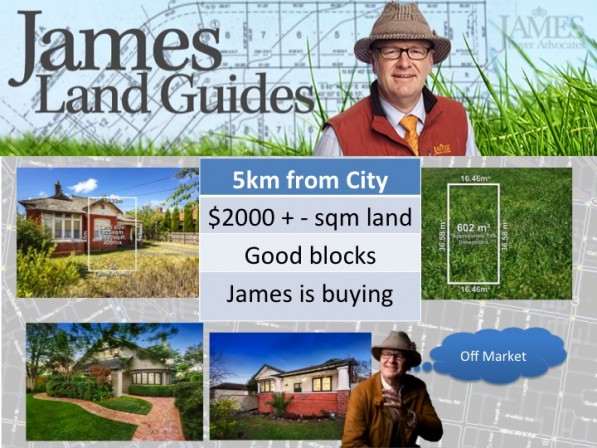

Opportunity One:

Really this is true. Hands up who can name one suburb in Melbourne where you can buy 600sqm+ blocks within 5kms of the CBD – with all the infrastructure you could want and a gentrifying attitude and it’s still around $2000 per square metre? We’ve deliberately left it off the land maps above.

Yes the game has changed, but there are still opportunities.

Opportunity Two:

Bayside may have been undervalued for years and we have been buying for many clients for many years. But the genie is leaking out. Today we bought Brickwood Street, Brighton (David Hart) for an investor client. It was a smart buy on their behalf. It is getting harder and will continue to do so for investors and homebuyers alike, if the tsunami of Overseas interest continues to hit Bayside over the next few years. See above graphic from our James Client Land Guides for comparable kilometre distances.

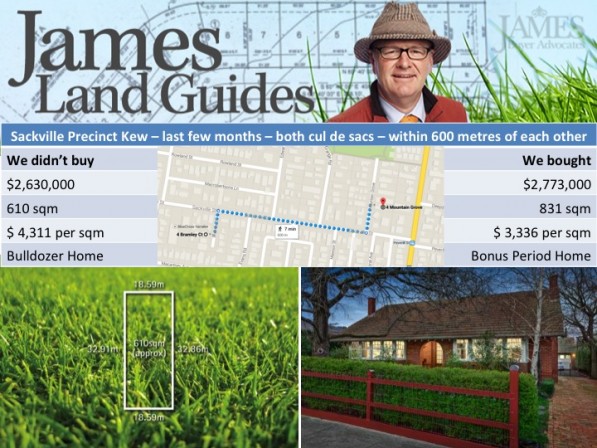

Opportunity Three:

In Melbourne right now land values “drop per square metre” when certain types of homes are attached.

So yes, you can bid against overseas buyers on land only buys at auction time. But if you think laterally, you may find a better deal. We are recommending those opportunities to our clients.

In 15 years time a brand new home will look the same and probably be valued the same as a 90’s home is now. Buildings can go up in value for the first few years, eg seven to ten years. After that they tend to fall in value.

Next week more on the James Land Values Report.

Agent Survey: What do you think is the biggest single factor driving the current market? How long will this strong market continue for?

James Tostevin (Marshall White, Hawthorn)

There is one significant factor driving the current market. Asian buyers have always had a strong presence in the Boroondara/Whitehorse market, they now have a dominant presence and there are very few properties, including period homes that are not of interest to them.

With the Australian Dollar at the level it’s currently at and interest rates likely to be further reduced in the very near future, I am anticipating the market will remain exceptionally strong for the balance of 2015.

David Hart (Buxton, Brighton)

The influence the Asian buyers are having on the Brighton market is profound. In recent months, the number of Asian buyers entering the Brighton market has increased exponentially. Clearly, the Brighton lifestyle, coupled with the extensive local infrastructure are of enormous appeal.

With the simple rules of supply and demand, my view is there will be no change in the prevailing strong market conditions in the next 6 to12 months, although I’m no economist!

Arch Staver (Nelson Alexander, Fitzroy)

My sense is that strong results in the East and middle ring suburbs is being read about in the inner suburbs and this is having some sort of a knock on effect. This market seems more sentiment driven than anything, the “haves” can borrow money quite cheaply so they are out shopping, however, nobody really knows what the single driver of the market is at the moment, but repeated annual growth of 10% or more isn’t really sustainable if we are serious about addressing housing affordability.

Good houses will continue to outperform, however, six weeks does not make a market. Supply levels have been low and more is only really coming on now, so it will take until May for a clearer indication of how the market is truly performing. I expect level heads and common sense will prevail.