The story of the day. Big crowds – No Bids. Brighton to Albert Park to Toorak to Hawthorn, the story was the same: Nothing happened.

At 6.00pm the James Clearance rate for $M+ Inner Melbourne family homes was 31% on the 35 Auctions we covered today.

This was the poorest recorded clearance rate on record (ever).

James Bidderman that is, bidders per auction, was 0.7 – a very negative stat for the start of the Spring market.

This was the equal poorest recorded Bidderman on record (ever).

Last week we stated the market seemed a little bit perky and our company has had a very strong last week, on both sides of the fence – see below.

However on today’s results (in isolation) “perky” would represent an inaccurate description.

For if the home was priced poorly or it was a B or C grader home, then it attracted limited or no interest.

80% of auctioned homes today attracted one or no bidders (see graph below).

That’s 8 from 10 – two years ago that was the Clearance Rate for success.

“Mal, you’re being overly dramatic, a lot of the pass-ins sold later in the afternoon.”

Not true!

I have never seen this before but not one of the 24 (out of 35) homes that were passed-in longer than a few minutes were reported to us as sold later in the day.

Not one – it was the GFC when I last saw that and not on this sort of large sample size.

Across the Board – all the same.

We covered 10 auctions in Bayside – we saw 3 bidders in total.

We covered 13 auctions in Stonnington and if you take out the 2 volcanoes (see below) there were 5 bidders at the other 11 auctions.

In Boroondara we covered 12 auctions and 9 of them had no bidders at all.

These are the real stats and they speak for themselves BUT we feel the market is better than May.

We could be wrong, but we honestly believe that the market was weaker than it was showing in May and it’s stronger than the stats are showing now – the rider – the comment applies to A-grade and market priced properties only.

- Well priced A-Graders (PPP’s) are still getting a run. For example, we were well and truly outbid on a home last weekend in Armadale

- AND when you get the pricing right, very good results can still happen – look at Edzell, Pine & McEvoy (12 bidders between them)

- AND at the Top End, away from the AUCTION market, there is some activity (Off-market, see Inside James below).

Why do we say we feel the market is stronger than these stats show?

Because the buyers are there, they are just incredibly uncertain and if others bid they will, but if nobody bids, for the most part, they won’t.

Why are our buyers so uncertain?

Price, the price is why buyers are uncertain, no buyer wants to “overpay” or feel they are “overpaying”.

Why would you auction a home if you are knowingly overpriced?

All you do is spend $30,000 to tell the market your home is overpriced.

One of only two volcanoes reported today. Tom McCarthy at 9 Pine Grove, Malvern. Not a huge crowd, but 4 strong bidders. A-Grade property (with many options), honest and accurate quoting, good agent and smart seller who listened to accurate advice.

What/who creates bidding?

Two years ago any home, any selling agent, any auction gavel created bidding.

But:

- Then came difficulties getting money out of China and increasing Australian taxes

- Followed by bank tightening to overseas and then local buyers

- Followed by the building snowball of a loss of local confidence

And:

Now with the market easing down (phew!), only:

Accurate market pricing creates bidding!

No not deliberate, systemic underquoting – that’s illegal and agents and agencies should be heavily penalised.

We are not talking about underquoting but conservative and smart quoting.

Which can only be done by:

- Seller Advocates and selling agents with honest intent and experience who understand and communicate, it’s a changing market

- And provide constant campaign feedback where adjustments are made

- With a seller who understands that to sell in this market, you must almost always be priced to market, not priced to your past opinions AND that wam, bam thank you Mám, auction, auction, auction now fails, more times than it works.

As we said last week, this market is one of the extremes. If you are warm (good pricing and interest) you can get hot. However, like the weather, it is now far more common that if you are cold, you are freezing.

For our buyers, the positive news is that B and C homes are not having the “natural” price increases and/or runaway auctions of 18 months, even 12 months ago.

The not so good news for our buyers: A-grade homes are a lot rarer on the ground because equally uncertain sellers are holding them back from auctions although, a smaller percentage are running some through the Off-market, AND when you do find an A-grader, sometimes all it takes is:

One bidder to push you and ultimately the price, well past the logic of last year – 10% right up to last year + 10%.

And that is why we put to you, that you need a good game plan, experience and good advice.

10% less or 10% more = 20% difference. On $3,000,000 = $600,000. On $8,000,000 = $1,600,000.

When do we bid?

When do we compete and

When do we pass, as there will be another one?

Today’s Graph Legend of Melbourne’s auctions: Ducks and Lones are zero or one bidder (not an auction); Norms are 2 to 3 bidders (real auctions) and Volcanoes are 4 or more bidders (ripper auctions).

There is no denying today was the weakest en-masse auction performance we have seen stats wise (ever). Let’s see if the combined results of the James three-week 100 auction test confirm a disaster start to the Spring Market after our third and final week’s report, next week or was today merely an extreme anomaly.

Go Pies!

This could be criticised as a self-serving and biased section BUT it’s factual and supports why we don’t see the market as bad as the stats.

In the last week we’ve been involved in:

- Bought – Off-market buying advocacy in Kew over $6 million (Walter Dodich – Kay and Burton),

- Bought – Off-market buying advocacy in Brighton over $3 million (Nick Johnstone – Nick Johnstone)

- Sold – Before close EOI selling advocacy in Balwyn over $4 million (Tim Picken – Kay and Burton)

- Sold – EOI selling advocacy in Toorak over $6 million (Michael Gibson – Kay and Burton)

- Missed – Under the Hammer, buying advocacy in Armadale over $3 million (Fraser Cahill – Marshall White)

3 of these 5 were or will be combination buying/selling engagements – meaning our clients have engaged us to help them buy and then manage the sell or vice-versa.

4 of these 5 were not at auction.

We are not always successful however, this 2018 spring market, whether buying or selling, it’s more than ever about strategy, experience and leverage with the right advocate/agent combination, rather than luck, inexperience, auction and hope.

Beaumaris – No Bids.

Only 2 volcanoes from 35 auctions covered.

Toorak, 13 Edzell Avenue. Fraser Cahill (Marshall White). Under the Hammer, $3,680,000 5 Bidders

Malvern, 9 & 11 Pine Grove. Tom McCarthy (Biggin & Scott). Under the Hammer, $3,355,000 4 Bidders

Read all 35 James Advocates Auction Reports here

Nothing to see here – Brighton East – No Bids.

Hampton, 17 Villeroy Street. Johnny Clarkson (Buxton). After auction, undisclosed, 1 Bidder

St Kilda, 29 Charles Street. Sam Hobbs (Marshall White). Before auction, undisclosed

Brighton, 56 New Street. Passed in $4,250,000 0 Bidders

Brighton East, 43 Studley Road. Passed in $2,800,000 0 Bidders

Brighton, 392 St Kilda Street. Passed in $2,800,000 0 Bidders

St Kilda, 19 Acland Street. Passed in $2,250,000 0 Bidders

Hampton, 78 Orlando Street. Passed in $1,900,000 0 Bidders

Beaumaris, 163 Tramway Parade. Passed in $1,800,000 1 Bidder

Hampton, 13 Kingston Street. Passed in $1,550,000 0 Bidders

Beaumaris, 26 Michael Street Passed in $1,200,000 0 Bidders

Read all 35 James Advocates Auction Reports here

Malvern East – No Bids

South Yarra, 70W Toorak Road. Gowan Stubbings (Kay & Burton). Before auction, $3,875,000

Prahran, 10 Doon Street. Simon Shrimpton (Jellis Craig). Under the Hammer, $1,560,000 2 Bidders

South Yarra, 32 Avoca Street. Gerald Delany (Kay & Burton). After auction, undisclosed, 1 Bidder

Toorak, 1 Mandeville Crescent. Tim Wilson (RT Edgar). Before auction, undisclosed.

Toorak, 12 Hill Street. Passed in $6,700,000 0 Bidders

Malvern East, 29 Belson Street. Passed in $3,500,000 0 Bidders

South Yarra, 64 Oban Street. Passed in $2,700,000 0 Bidders

Malvern, 19 Bonview Road. Passed in $2,700,000 0 Bidders

Malvern East, 16 Forster Avenue. Passed in $1,750,000 0 Bidders

Prahran, 37 Wrights Terrace. Passed in $1,700,000 0 Bidders

Read all 35 James Advocates Auction Reports here

Camberwell – Big Crowd – No bids.

Kew, 11 McEvoy Street. James Tostevin (Marshall White). Under the Hammer, $2,831,000 3 Bidders

Surrey Hills, 8 Thistle Street. James Tostevin (Marshall White). After auction, undisclosed 2 Bidders

Hawthorn East, 18 Cole Street. Michael Wood (Marshall White). After auction, undisclosed, 0 Bidders

Hawthorn, 16 Oak Street. Passed in $5,000,000 0 Bidders

Camberwell, 28 Merton Street. Passed in $3,550,000 0 Bidders

Surrey Hills, 45 Florence Road. Passed in $3,100,000 0 Bidders

Hawthorn East, 47 Havelock Road. Passed in $3,100,000 0 Bidders

Hawthorn East, 28 Mount Ida Avenue. Passed in $2,360,000 2 Bidders

Surrey Hills, 2 Suffolk Road. Passed in $2,200,000 0 Bidders

Hawthorn, 9 Leslie Street. Passed in $1,900,000 0 Bidders

Read all 35 James Advocates Auction Reports here

Love you Dad – David James – 90 years old.

Homes we have bought through James Buyer Advocacy and a number we have resold through James Seller Advocacy

Think Selling Advocate before you think Selling Agent

You can’t market and sell to nobody – you need your best possible strategy in the first place.

Think Strategy before Marketing

Buyer advocates also have to respond to the changing markets or else they are not maximising their clients’ buyer positions. For instance in this market if you are not into seller advocacy as well, then possibly you are weakening your other clients’ buying positions in terms of leverage, stock access and knowledge.

Is a selling strategy important?

When you spend $30,000 on advertising for a failed auction and all that’s achieved is, you’ve told everybody what your home is not worth – is that a good strategy?

Read the Full Article on James Seller Advocacy

Which agent is best?

Auction or private sale and does off-market work?

The agents say the market is OK, but is it? We see a lot of pass-ins.

Read the Full Article on James Seller Advocacy

In some cases, our selling advocacy service is no additional charge.

When 67% of homes are not selling at an auction.

When the market has changed but your selling agent hasn’t, isn’t it time to think differently lest you get the same failed result (which you may, but at least give yourself a chance or go in fully informed).

Why not consider a selling advocate to advise you first, before you meet the selling agents?

Read the Full Article on James Seller Advocacy

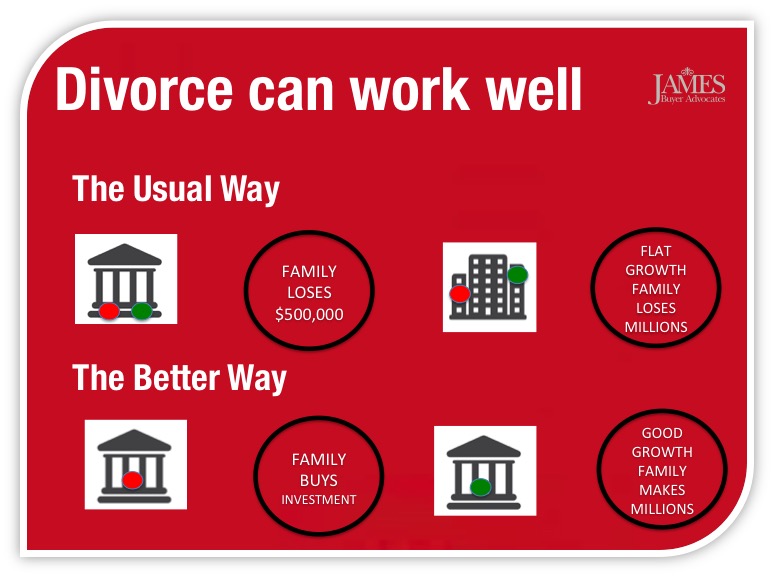

Last week’s Divorce article had a lot of feedback!

Divorce doesn’t have to mean the destruction of your family financially – well, it doesn’t if you’re a real man (woman).

Three very workable solutions to get divorced IF you don’t sell the family home.

Read the Full James Divorce Article

(below printed with permission)

Date: 27 August 2018 at 6:05:03 pm AEST

Subject: Re: Your article on divorce

Thanks Mal,

……….I read your articles as I find there are more and more people trying to copy what you do, but I think they forget that yes, it is a business, but also very much an area where trust is needed. The fact that you are straight to the point and don’t muck around comes across and I find that refreshing.

Kind regards,

Anna-Louise Brown (ASIC# 337 710)

eWealthBuild Pty Ltd

Authorised Representative

Certified Financial Planner

www.divorceplanner.com.au

M.A. (Cambridge, UK), Dip Fin Planning, Dip Fin (Mortgages)

CFP Practitioner Member : Financial Planning Association

Associate Member : Law Institute Victoria (non-legal, financial planning member)

Read the Full James Divorce Article