Sir, Madam, just another dollar, please. Kew, 78 Charles, Davide Lettieri, After Auction, Above $2,900,000, 2 bidders.

Welcome to our $2m-plus auction Early Spring season opener

Welcome to our $2m-plus auction Early Spring season opener

And the first of three weekends of the James 3 Week 100 Auctions Early Spring Market Test, specifically designed to measure the true market temperature of higher end, Inner Melbourne Family Homes.

This time last year, the opening Spring Day was a bit depressing and now it feels like we have just come out of what most were calling, “GFC May”.

So on this sunny opening day of the Spring Market how did we go?

Are things any better? In a nutshell – yes, slightly.

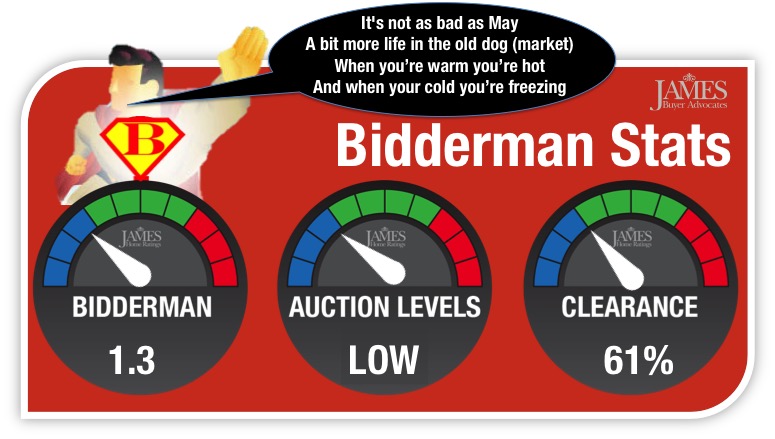

At 6.00pm the James Clearance rate for $M+ Inner Melbourne was a borderline 61% on the 33 Auctions we covered today.

James Bidderman that is, bidders per auction, was 1.3 – not a disaster like May (o.8), but nothing like the strength of the last five years (over 2 and even up to 3).

To us, the market has perked up a little, admittedly off a very low May base and we acknowledge there is usually an early Spring lift (as there is in February) and it’s still early days.

We are in what we would call an extremes market.

The question we would like to answer in this 3 Week 100 Auctions Early Spring Market Test is:

Is our market still falling?

Stock Levels

Today we struggled to find 33 family homes – this means good stock levels are low.

Price

Quote too high and you don’t get the bidding.

Buyers are uncertain and so they want to see others bid for vindication before they do.

High quotes and big asks are trouble, big trouble for sellers.

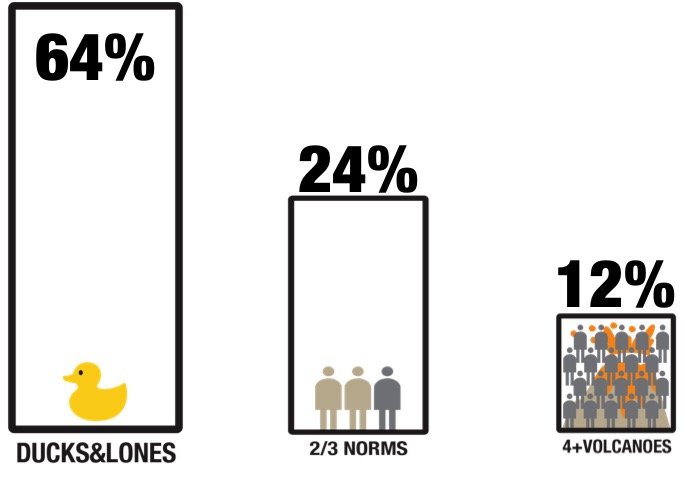

Price right and it could be getting a volcano (4 bidders), price wrong and it’s almost certainly a duck (0 bidders).

Marketing agents must get the pricing right if you want to sell.

Please note: We are not talking about condoning Underquoting – there is a clear difference between good quoting and underquoting. Excellent article in the latest Estate Agent publication by REIV president Richard Simpson. Some real leadership from within the REIV by calling underquoting out for what it is – damaging to our industry and stakeholders and illegal – please read it, it’s a really good article.

Why would all sellers auction?

We honestly don’t know.

A whopping 64% – think about this, 64% of auctions, were not really auctioned today, even though the sellers paid $20,000+ for the privilege of advertising and an auctioneer showed up.

Nothing else happened after that, for between 6 and 7 out of every 10 sellers.

64% of auctions had only one or no bidders at all.

They are not auctions, they are wakes.

Why are so many sellers auctioning their home?

It just doesn’t make sense for some to auction, as all you are doing is telling everybody what your home is not worth.

Early morning today at a pre-auction coffee client meeting at Porgie and Mr Jones in Hawthorn East and in comes the press. I was just getting my speech ready about bringing Australia together, when they went right past me to the blokes at the next table, the newly-minted deputy Prime Minister, Josh Frydenberg and fellow old stager Mr Peter Costello. Who says at James, we don’t mix in the circles of power!

Let’s give these guys and girls a show Nick! Sandringham, 45 Sims, Stephen Tickell, Under the hammer, $2,310,000, with 5 Bidders (they did)

Canterbury, 96 Mont Albert Road. Geoff Hall – Kay & Burton. Under the hammer, $3,502,000 4 Bidders

Sandringham, 45 Sims Street. Stephen Tickell – Hocking Stuart. Under the hammer, $2,310,000 5 Bidders

South Melbourne, 13 Ward Street. Kaine Lanyon – Marshall White. Under the hammer, $1,865,000 4 Bidders

South Melbourne, 300 Bank Street. David Wood – Hocking Stuart. Under the hammer, $1,201,000 4 Bidders

Hawthorn, 36 Urquhart Street. Passed in $3,200,000 0 Bidders

Hampton, 20 Bridge Street. Passed in $3,100,000 1 Bidder

Malvern, 421 Glenferrie Road. Passed in $3,000,000 0 Bidders

Read all 33 James Auction Reports here

Armadale, 12 Ashleigh Road, Fraser Cahill, Under the Hammer, $3,180,000, 3 Bidders

Auctions these days are a balancing act. Malvern East, 5 Allenby Avenue , Tim Derham (immaculate pant leg creases) with Jeff Gole, Passed in $1,900,000. Sold after auction, 2 bidders.

South Yarra, 23 Airlie Street. Anthony Grimwade – RT Edgar. Before auction, undisclosed.

Armadale, 12 Ashleigh Road Armadale. Fraser Cahill – Marshall White. Under the hammer, $3,180,000 3 Bidders

Malvern East, 45 Allenby Avenue. Tim Derham – Abercromby’s. After auction, undisclosed. 2 Bidders

Read all 33 James Auction Reports here

Mmmm, is that the ice-cream van, I’m famished? Brighton, 5 Rooding, Nick Johnstone, After Auction, over $2,200,000, 0 Bidders.

Brighton East, 36 Camperdown Street. Steven Smith – Marshall White. Under the hammer, $4,060,000 3 Bidders

Brighton East, 9 Summerhill Road. David Hart – Buxton. After auction, undisclosed (between $2,500,000 and $2,600,000) 2 Bidders

Brighton, 5 Rooding Street. Nick Johnstone – Nick Johnstone Real Estate. After auction, undisclosed (just short of $2,250,000) 0 Bidders

Read all 33 James Auction Reports here

My fellow Australians……Is that Josh Frydenberg again doing the auction? No, it’s Steve Abbott, 12 Derby Camberwell, Under the Hammer, $3,800,000, 2 bidders…….Cut……make up!

Camberwell, 12 Derby Street. Steven Abbott – Jellis Craig. Under the hammer $3,800,000 2 Bidders

Kew, 78 Charles Street. Davide Lettieri – Marshall White. After auction $2,915,000 2 Bidders

Hawthorn, 4 Lennox Street. Antony Woodley – Marshall White. After auction undisclosed 1 Bidder

Read all 33 James Auction Reports here

Canterbury, 96 Mont Albert Road, Geoff Hall, Under the Hammer, $3,502,000, 4 Bidders

Divorce, the Children and a Better Way.

This is an ongoing part of our multi-generational living series.

If the unhelpful events of Canberra of this past week have reminded us of anything – it is that the sum of divided individuals is far less than the value of a united group.

It’s exactly what happens in a divorce when it comes to property.

From my experiences in advising on property strategies for close to a hundred families or individuals (mainly women) divorcing – this has been a lesson, I have seen time and time again.

But bang, it doesn’t have to be like this – it really doesn’t.

You can still “hate” each other and both get of out it relatively unscathed financially – if both of you can see things differently and care about your children first.

Yes, you can survive a divorce financially and come out in good shape and possibly even better (as a group) if you can;

- Both look at a bigger picture, a longer-term one

- Put your family’s needs ahead of revenge

- Understand about lawyers, the good and not so good bits and how they are set up

Diagrammatically, below is how many dumb divorces work (the usual way) and how a few smart divorces can work (the better way).

The Usual Dumb Way

Husband and wife living in a family home with two children.

$3 million in value and a $2 million mortgage

A spouse moves out and it seems the only alternative is to put the home on the market.

- In this down market, the costs of doing that are $100,000 in agent, advertising and conveyancing fees and bank stuff

- Next, both spouses are left with $450,000 each and they buy a $1 million townhouse (cost of each in fees around $80,000 – stamps etc)

- On top of that, they have had to do it through lawyers and let’s say $100,000 each put onto their mortgage.

So one year ago the family had $1,000,000 in combined net property assets $3,000,000 – $2,000,000 = $1,000,000

Now the family has combined $1,000,000 – lawyers ($200,000) – selling costs ($100,000) – minus buying costs ($160,000) = $540,000

But wait there is more

They sold in a down market (now), so they lost another $100,000 and they bought brand new poorly built townhouses/apartments (all they could afford) and they were only worth $950,000 each and so that’s another in total, $200,000 off your $540,000 new combined wealth and you are down to $340,000

But wait there is more

Your inflated townhouses/apartments grow at 4% over the next 10 years, as they are further out and so in 10 years your combined family wealth, for your children is $484,000.

About half of what it was before the divorce 10 years before.

But wait there is more

The family home (that you forced each other to sell) grew at 8% and so in 10 years was worth $6,000,000 and after mortgage of $2,000,000 = $4,000,000 in net family assets.

What’s that, 8 times the net family wealth if you didn’t sell.

Oh, but Mal, you’re not living in a real world, what about emotion and infidelity and mental illness and ………….

My answer back to you is always and what about your children, sir or madam?

What about yourself?

Give ground and avoid the lawyer’s deluxe fee version of a court fight, because even if you won 100% of the fight and sold the home = $484,000; you are miles behind winning 30% and the spouse or you keeping the home = $1,200,000.

Hold the phone – what about living together (we can’t do that anymore, she’s a bitch and he’s a bastard), what about bringing in the new model (wife or husband?).

Three very workable solutions to get divorced IF you don’t sell the family home.

- Whichever spouse moves out, you buy an investment property for – using your equity in the family home, that you didn’t trash financially AND you buy it together (OMG)

- You deal in %, not $ – so going forward, you have percentages not dollars as far as divvying up. Even with new spouses, you can manage this. Keep the assets, divvy up the debt!

- Written lawyer approved agreements based on a dislike, even lack of trust for each other, BUT a love for your children and their family (which includes both of you).

It’s not practical Mal, not the real world!

I can be a very disagreeable character at times and my ex-wives will attest to that and largely they are right – but this time, the second time around, total lawyer costs were below $40,000 and no homes were sold. Wife stayed in the family home and I stayed in a jointly owned investment home.

This took three years to find a way forward and during that time by not selling the family home or any others, our assets went up $2,000,000 (2015 and 2016) and the cost was only $40,000 in lawyer fees.

At an appropriate time a transfer was made (no stamp duty as it was spouse to spouse).

My wife and I could see there was a real benefit for our children in finding a way to not sell homes. We have a testy at times but improving relationship today, live our own lives and have the same assets as we did 5 years ago – they are just worth a helluva lot more. It wasn’t easy, but it was a smart and caring way to see the best way forward for our children.

Blokes, you are not a real man if you financially beat up your wife (the mother of your children), if you trash your kid’s (flesh and blood) chances to have a future and you live in a shitbox apartment because you had to prove you were right and the courts didn’t agree with you.

We all witnessed the destruction one man unleashed on our whole nation this week, that is what revenge does. Yes, he was hardly done by a few years back, but he wasn’t a big enough man to put our nation’s interests ahead of his and suck it up. Instead, he cloaked his revenge in policy disagreements and involved us all in his fight. And for what? In the end, what did he achieve? Nothing, except to diminish himself.

Not mad at him, actually feel sorry for him – he is a man still hurting, a man unable to deal with his feelings in a constructive manner AND living in Canberra there are too many other agendas, for him to get some love and clear air, to start his road to his recovery.

So I put to you, the real tough guys in a divorce, the real men, take a little less, even when it’s all her fault and we all know it is (joke) and she’s gone ballistic at you (as she does).

Why? BECAUSE you’ve got a brain, some common decency and a moral compass AND you’ll end up in front AND your kids will too.

Your children want leadership from you, they want to learn how to act under pressure and still treat people with decency – they want to know they are loved more than your bank account scorecard. However, as shown above, the scorecard will come out in your and your children’s favour, if you can move your strategy goals from revenge to regeneration, from winners and losers to winners only and from all about you to all about your family (which you’re a part of).

Please don’t blame your lawyer – grow some and tell your lawyer you want a win for your family, not his, the lawyer’s family – put up with some unfair crap now (from the other side) and look for a family win by keeping the assets for you, your children and yes, even her (or him) intact – especially the family home!

Lawyers – some lawyers see you as a job and each job needs to be $50,000 to $100,000 in fees? Of course, they will find issues and before long you are knee deep in a court case and a combined $200,000 legal bill.

There are winners, but they are not you or your spouse or your children – they are your lawyers.

Not all lawyers are problems, in our case, we had good lawyers – we were the difficult ones.

Girls, if a bloke is actually trying to find a reasonable way forward for you, even if he’s done what you think is really bad and you don’t believe he deserves anything, this could be best for you and your kids (your kids remember them!).

On the other hand, if your ex is being a dick then never, ever, ever give up the family home – no matter what the pressures are – fight all the way to keep it.

It is your’s and your children’s financial good future.

Girls, pressure is pressure – being 70% stressed is no different to being 90% stressed, so try and keep the home.

Managing property through a divorce can work out for everyone, if you’re smart AND you really, truly love your family, your children AND you have smart end goals.

Divorce doesn’t have to mean the destruction of your family financially – well it doesn’t if you’re a real man (woman)!

These above opinions do not apply where there is a family violence situation. There will be arguments and raised voices and heaviness and hopefully you can get through those – try your hardest to keep the temperature down, rather than escalate through exaggeration (for you and your children’s sake). However, violence or threats thereof are unacceptable. Don’t hesitate to call the police immediately 000 or Lifeline 13 11 14.

We reckon you’re both the right stuff for our country

Go ScoMo and Josh

Need a Victorian team Scomo – Go Pies!!