We’ve been back into it – OFI’s, off markets, phone calls and coffees, two buys already and a solid and building buying client base. The mood was balanced and pleasant out there today – really enjoyable start to the year. Good to be alive.

Isabella and Sophie with Scott at the impressive 18 Alfred St, Kew – this will set a benchmark, this will show early 2018 market strength in the Sackville Ward for high quality, new builds especially attractive to many Asian and Asian/Aussie buyers.

Hello everybody for 2018!

As is our tradition, it’s a decidedly lightweight first-up Market News, as we ease our way back into the saddle. Giddy-up!

Today was the first serious day of opens and we have started the year with a some impetus having bought two homes already; contrasting with the flat feeling the market left for most buyers late last year.

The sense around the opens today was one of balance – quiet optimism with nothing gushing or urgent, unlike that shown during the openings of the previous three years and nothing flat like the pancake start to spring 2017.

The sun was out, the punters polite and the agents friendly and real.

Talking to a number of agents in Booroondara, Simone and I got the general feeling that agents felt they had listed well and that sellers’ expectations were reasonable.

Gina, Kathy and Randall got the same vibe in Bayside and Stonnington.

We think the best summation of today was a general air of enthusiasm – both buyers and sellers appeared balanced and pleasant.

Gina with Joanna Nairn at 61 Murray St, Prahran today. Inspecting, talking, finding off markets, catching the goss!

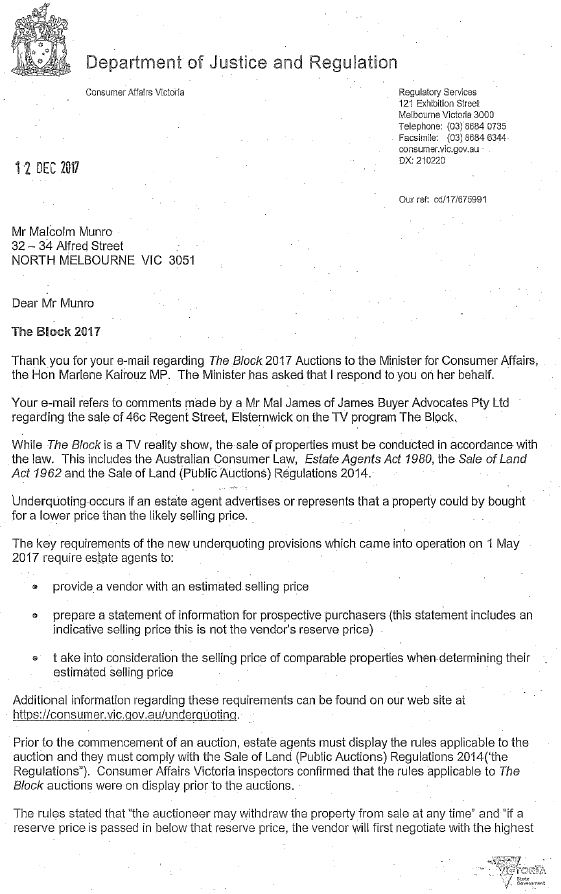

A polite exchange of letters occurred in the Christmas 2017 week between James Buyer Advocates and Consumer Affairs Victoria.

Whilst we disagree with the findings, we accept CAV investigated “The Block” matter and have made their final decision. We respect the communications sent to us.

However we feel this really does throw the auction market wide open, with sellers now having open slather and basically no restrictions on what they can say to the market.

It really is, more than ever, buyer beware!

Summary of your position as a buyer – almost zero CAV protections with regards to seller price directions.

1) There are more warranties on a $1,000 dishwasher than on a $5,000,000 home. In fact, if you buy the dishwasher from Harvey Norman it has to work; but if you buy it in a $5,000,000 home it does not.

2) Unlike in retail, when selling a fridge Myer or Harvey Norman cannot mislead you with price; a seller of a $3,000,000 home can say to you any price they like:

– change their mind at anytime and

– be completely immune from prosecution under the current laws, if they mislead you, the buyer – (see below letters).

3) The current legislation around pricing has made a difference with regards to agents (and we commend the CAV with regards to their agent underquoting crackdowns). However, there is a major gap or flaw now open by what we call “The Block” decision in relation to sellers’ fair play and responsibilities, with regards to the Auction Reserve.

It will need addressing, hopefully in 2018.

With Chris Barrett – hope your horse won today at the track Chris, we all know you are on an “odds/on” at 29 Grove Road Hawthorn.

Good home with a beautiful upstairs and downstairs rear. No doubt a solid percentage of the large numbers through today also thought that. Starting quote high $3m’s and justifiably so for 29 Grove Rd, Hawthorn.

With Andrew Hayne at 42 Berkeley, Hawthorn – Scotch or MLC family home buyer with tennis court. Quoting over $8m.

As you may be aware in 2017, we focused on the 4 major seasons of reporting to assess market depth, health and volatility by conducting our 3-week 100 auction tests – carried out 4 times.

We received positive feedback that we had moved away from the weekly “ups and downs” commentary. Weekly commentary on the overall market was seen as becoming a meaningless blur of inconsistent comment, as a wide range of “experts and journalists” were basing their output on small samples and anecdotes – which by their very nature, had to produce statistical anomalies.

So we moved to 4 measurements a year – The big 4 – the Market Majors if you like – 100 randomly selected auctions over 3 weeks.

1st Major – Opening Market – February 24th, March 3rd and March 17th

2nd Major – May Market – May 12th, 19th and 26th

3rd Major – Early Spring – late August/ early September

4th Major – Late Spring Last week in October and two weeks in November.

What are the key indicators we use in our 100 auction market test?

The three key indicators are;

1. demand which is best measured with James Bidderman (bidders per auction)

2. supply (stock levels) and;

3. price connection (clearance rates)

How does this information help you?

This sort of information is of course general, so you still very much need to do your specific research on each property, to maximise your opportunities and mitigate your risks as best you can, when it comes to making decisions on buying or selling a home. However, macro market indicators give good context to possible variances, after you first plant your value and negotiation foundations.

For instance, it became obvious by the Bidderman stat dropping to 1 (1 bidder per auction) late last year that if you were selling, it may be a good idea to have some flexibility on any above market price, should your initial campaign not fly. Alternatively, as a buyer this sort of information helped calm the nerves a little and minimise the rash raising of pricing in post auction dealings, as you knew there was an improving chance of no competition or finding a more realistically priced home.

Market indicators are just that, indicators – for our company they are good guides as to when and by how much we may need to move off our initial starting points, should they prove unsuccessful. Perhaps useful when you hear the other side claim, “well it went for such and such last year and now it should have increased by (x).” Mmmm, let’s wait and see how the first big market test stats pan out.

James & James (Tostevin and Mal) – look closely, a glint in both their eyes, a new market must be open for business. 118 Walpole St Kew, good rambling, circa $3m family home.

Good Tip – the do’s and don’ts of agent hair care

Below: Gina with Jen Dwyer at 54 Mills, Hampton today – shooting the breeze, no doubt some deals in the offing – love the new hairstyle Jen.

Speaking of hair styles and in the interests of equality – while that’s a yes to you Jen, that’s a no to you below Mr Steve Abbott – mmmm – I’ll give it a week (tops!).

Arriving by boat at 4 Yarra Grove, Hawthorn? Well not really, but this home does have a jetty and mooring and was a home we inspected today – some champers would have gone down nicely. $7.3m to $8m is the quote with Tom Staughton, Scott Patterson (below) and Michael Gibson.