“This is all very interesting Mum, but it’s still Greek to me” as Kathy Malcolm, Antony Woodley and team manage a volcano of 7 bidders to $2,590,000 at 30 College Parade, Kew.

It’s 6.00pm Saturday and the James Clearance rate for $M+ Inner Melbourne is still a very strong 83% on the 29 Auctions we covered today.

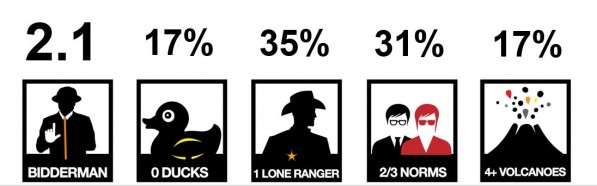

However James Bidderman, that is bidders per auction, was only 2.1.

What does this mean?

Well it may just be a statistical anomaly – we had a lot of bought befores and we record that as one bidder in our stats – removing the 6 bought befores then Bidderman was 2.4.

Bidderman is still healthy and it may be that with so much stock being bought and sold in the last few weeks – the market is taking a little bit of a “gorging breather”.

Or of course it may mean that the market is adjusting from its rocket out of the blocks start to 2017, to something a little more subdued.

Between now and Easter we will get a better gauge of any market twisting and turning.

We would expect May to ease a tad as it tends to historically, due to higher stock levels.

Our read; the market remains strong and is settling.

Balance: The increased negative talk in the property market, as it relates to the Inner Melbourne market could be unhelpful, if you are looking to buy.

But Mal, that is your self interest speaking, you earn a living from this market and you make a better living in a healthy Inner Melbourne market.

Yep guilty as charged, however that alone doesn’t make the above comment for a lot of Inner Melbourne buyers inaccurate.

It is true, that the Inner Melbourne market could “begin a crash” tomorrow; as it did in 1990 and again in 2008, when the market dropped by around 20% in 6 months.

It is also true, that the Inner Melbourne market in 2017, could rise another 10% as it has in 2009, 2012, 2013, 2014, 2015 and 2016.

Headlines implying that the market is at the lowest level in confidence in a long time are patently untrue with regards to Inner Melbourne.

The bidder number at auctions measurement, James Bidderman has been operating at a strong to very strong level for several years and it has been consistent – granted today it did see a dip.

The economists and assistant governors and others, implying that all housing markets are at dangerous levels is ……………. a carte blanche commentating approach on all of the Australia markets ……. AND by not adding more information, they could be unhelpful statements, if you are looking to buy a home in Inner Melbourne.

We are not implying that you should throw caution to the wind and stretch and stretch.

We are saying that the Inner Melbourne market is still strong and looking like it will stay that way for the moment and you need to be prepared for that when thinking of buying.

Please Note: You should always have some buffer for an unexpected interest rate increase or unexpected loss of employment or illness in your monetary considerations – however that is very different from just giving up and not buying.

The Australian housing market is made up of many smaller markets like the Adelaide market, the mining towns markets, the Inner Melbourne, Outer Melbourne and regional markets, the apartment markets and the holiday coast markets and ………….so on.

Big crowd of over 100, witnessed 2 bidders fighting out a Steve Abbott auction at 37 Victoria, Camberwell to an after auction deal over $4,760,000.

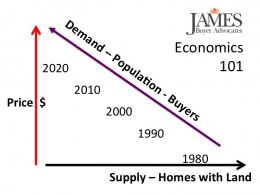

All of those markets are demand and supply driven – but not by the same demand and supply driver criteria.

Perth went up and down at a lightning pace, not driven by overseas immigration and lack of land; but by mining wealth.

The Outer Melbourne market is driven by interest rates and employment and the fact there is plenty of supply (land developments).

Our Inner Melbourne market is also driven by demand and supply – but the leading demand factors are overseas skilled migrants wanting to be near private schools, overseas investment (wanting to make a long term profit), investors using negative gearing strategies and of course many locals just wanting to live in Inner Melbourne due to the infrastructure (trains, shops and schools) and their own personal history.

The Inner Melbourne market is very much now an international market with a limited supply (while in outer Melbourne you open up another land development, in Inner Melbourne that is so much more difficult) and operates on an asset exchange basis more so than an income exchange basis.

That is not to say that the Inner Melbourne market is immune from bad news or even significant market drops – it dropped more than other markets in the GFC – but the current fundamentals are not pointing to a long term market drop in Inner Melbourne.

Fundamentals for Inner Melbourne land and homes:

The Inner Melbourne market is affected by the Australian Dollar Exchange rate more so than the interest rate. (This is one to watch as interest rate rises push the Australian dollar up)

The Inner Melbourne market is affected by skilled immigration numbers just as much as the local employment stats. (Skilled migrants mean skilled money managers and they want to live Inner Melbourne, so as their children can go to good schools)

The Inner Melbourne market is affected by lack of land more so than outer Melbourne and other regional markets. (I’m not the smartest sandwich in the picnic and I haven’t worked out how they can make more land in Inner Melbourne)

And yes the The Inner Melbourne market is also affected by the earning power and confidence of locals who have to borrow.

And finally the biggest Inner Melbourne market factor – population growth.

Balance: If you are wanting to buy good land with a good home in Inner Melbourne, then please consider that:

1) The Inner Melbourne markets do fluctuate and buy for the longer term, to reduce short term fluctuation risks.

2) The Inner Melbourne market has had significant drops on a few occasions in the past HOWEVER when that happens, it is even harder to buy good homes as sellers simply do not sell AND on all occasions in both relative and real terms, the market has rebounded back past the drops and the previous records set. Yes in the 1990’s that took 7 years, and yes, historical data is no guarantee of future performance – that is true.

3) The Inner Melbourne home and land market is very different from the Inner Melbourne apartment market and from the high-end Perth market and the Midwest United States market and ………. long term, the Inner Melbourne market has proven to be one of the more resilient markets in the world AND currently;

4) The demand and supply fundamentals driving the Inner Melbourne market appear solid – skilled migration, negative gearing, population increases, availability of money and no more large land blocks and Bidderman.

Our biased but professional current (and future) recommendations with regards to buying: Look longer term in your purchase horizons AND do not pass on a good opportunity (sound fundamentals) now, believing there has to be a better one in the future.

Our Top 3 sound PPP fundamentals remain the same in any era:

1) POSITION: Inner, near rail, improving street

2) PRICE: Buy at a fair price with good land content to price ratio and buy now, with a long term hold view (if it’s the right home for you), rather than wait AND;

3) PROPERTY: Buy what you really, really want (work through a process as to what that really means – eg mortgage v lifestyle, emotional v economic, now v future, position etc). Buy good land with a workable floor plan and light.

Some of the Bidderbizz auctions we covered today.

Kew, 30 College Parade (Kathy Malcolm) – Under the Hammer $2,590,000, 7 bidders

Albert Park, 90 Danks Street (Michael Paproth) – After Auction over $2,800,000, 6 bidders

Elsternwick, 15 Murray Street (Bill Stavrakis) – Under the Hammer $3,000,000, 5 bidders

Rocco Montanaro auctioned 36 College Street, Hawthorn. Under the Hammer, 3 bidders, $2,265,000.

Hawthorn, 6 Dean Avenue (Antony Woodley) – Under the Hammer $4,300,000, 2 bidders

Kew, 35 Barrington Avenue (Scott Paterson) – After Auction $4,300,000, 3 bidders

Hawthorn East, 14 Westley Street (Doug McLauchlan) – Under the Hammer $3,150,000, 4 bidders

Read all auction reports here.

Greg Hocking growls a little bit to kick things along until 97 Page Street, Albert Park was put on the market at $2,360,000. But his mood improved as 3 bidders added another $600,000 and then some to a final result of $3,010,000.

Brighton, 9 Newbay Crescent – Under the Hammer $3,922,500, 3 bidders

Hampton, 75 Crisp Street (Robin Parker) – Under the Hammer $3,201,000, 5 bidders

Albert Park, 97 Page Street (Greg Hocking) – Under the Hammer $3,010,000, 3 bidders

Read all auction reports here.

Malvern East, 10 Manning Road – After Auction over $6,000,000, 1 bidder

Toorak, 10 Highgate Street – Pass In $5,205,000, 1 bidder

Malvern, 9 Fraser Street (John Morrisby) – Under the Hammer $3,010,000, 3 bidders

Read all auction reports here.

This week in Inside James Buyer Advocates, we focus on our lower end auctions.

We were successful at 5 from 6.

Our clients were involved in family home auction negotiations in Brighton (Kate Strickland -$2M), Surrey Hills (Gail Logan – $2M), Kew (Kathy Malcolm – $2M), Mont Albert (James Tostevin – $3M), Hawthorn (Rocco Montanaro – $2M) and Kew again (Maurice DiMarzio – $3M).

We found the going tough, the prices we paid were strong as they involved competition; however, we were able to secure the homes with strategies that worked.

Tip of the Week (1): If you still think buying a home in 2017 is about rocking up to an auction, putting your hand up and taking whatever comes – then there’s an increased chance you were one of the 270 that missed a fortnight ago or one of the 160 that missed this week. Your competition is not only the agent, your competition is also from the pool of (270+160=430) other buyers.

Tip of the Week (2): Running a successful business is about having a plan, hiring good help and working hard. Buying a home in 2017 is no different – it’s just a lot more of your money!!

Tip of the Week (3): For buyers who are still looking for fair homes at wonderful prices, can we suggest you tweak your plan to wonderful homes at fair prices (to misquote Warren Buffett). If you didn’t buy or engage an advocate in early 2015 to buy your dream home – it is now 20% more expensive in real terms – that’s a lot more than a 1% advocate fee or another $10,000 bid.

Dear Young People, Malcolm Turnbull and Bill Shorten, Daniel Andrews and Matthew Guy,

Please consider Younger Homebuyers getting access to their Super Funds, to help them buy a home – please help YOUNG HOMEBUYERS level up the playing field.

Please don’t say the SUPER IDEA will start in 2025 – say it will start now – as the time for having children may pass some by during this time.

Granted, it will add a bit more fuel to the market fire – but is that a fair-go reason, not to help young people get onto a level playing field?

IT’S NOT A LEVEL PLAYING FIELD – REASON 1

When I, as a 57-year-old tax payer can go to an Inner Melbourne auction for $1 million and it cost me $20,000 of my income to buy it – YET for a young homebuyer it costs them $80,000 of their income to buy that same home. It’s not fair. This is not a level playing field.

IS THE MARKET OUT OF CONTROL, DANGEROUS OR IS IT JUST DOING WHAT IT SHOULD?

“Beggars belief – Defies logic – Unsustainable”

These are the headlines that in part, are being attached to the reasons why we should not help YOUNG PEOPLE with access to their super.

Can I ask why the authors of these headlines say this about the Inner Melbourne market?

What do they mean – what beggars belief in their mind?

That more and more people are wanting to come to Inner Melbourne?

That for all it’s internally recognised faults; Melbourne is seen externally as one of the truly great places in the world to bring up a family.

That political stability, business opportunities, an overarching community attitude of fair play, jobs, education, pollution, gun laws, health system, labour protections and………. are on the tick-off list of almost all skilled migrants in this world.

Why does our strong Inner Melbourne housing market, beggar belief?

Do the economists, bankers and other business people who are saying this, not believe in this century’s old economic demand and supply thesis.

What “defies logic” about the current Inner Melbourne housing and land market?

FALSE ASSUMPTIONS or DIFFERENT PERCEPTIONS

In a country, that for decades has been focused on “low fat”, only to become one of the obese nations of the world.

Is it defying logic to think that if we put more calories in (population), than we can exercise out (land), then our bellies will not explode (prices)?

IT’S NOT A LEVEL PLAYING FIELD – REASON 2

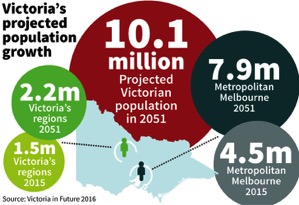

This government supported graphic below, is the Inner Melbourne home market price obesity issue.

This is another of the structural community decisions, that we as older people have made, that are IMPACTING YOUNG PEOPLE.

It’s great for us!

Our asset values go up; but it’s very difficult for young people who do not have housing assets.

The true Inner Melbourne market price obesity issue is population and the lack of discussion we have around the actual number, rather than the issues.

Are the above population figures acceptable or not – are they sustainable or not?

Yes a falling population has different issues – look at Japan.

However Inner Melbourne doesn’t have a falling population issue – we have the opposite.

So are we really in some unexplainable pricing bubble, so bad that we can’t help YOUNG people because the market is “dangerous”?

Or are we in a normal, but strong market explained by limited supply (land) and increasing demand (population); which affects young people UNFAIRLY because of structural inequities around negative gearing, skilled migration, overseas investment and so on.

One final world about unsustainability of the market, before we get back to young people – young sub-million homebuyers.

These days we are all talking about “unsustainable.”

We seem to be focused on “unsustainable” pricing, rather than our “unsustainable” society as a whole?

In 2030 when your children’s children (grandkids) are 2-3 hours away in Albury or Bendigo, because of housing affordability inequities; or you can’t get an ambulance driver or a teacher, because they can’t find housing in your local area – is that the unsustainable bit you should be talking about or is it pricing?

We live in a society with some issues, but compared to many in the world right now, Inner Melbourne is one of the great pluralistic societies.

We have many obsessions like footy and food and housing AND population growth.

And as our population grows, I’m with the well known economist from Toy Story, Buzz Lightyear who says the Inner Melbourne housing market will, without a change in circumstance, continue to rise, with a few interruptions, ’till infinity and beyond.

Of course there will be hiccups and of course those that cry wolf often enough about doom and gloom, will eventually be right – but in the longer term are we really in so much trouble, that we can’t help young people?

Possibly when an assistant at the Reserve Bank or a leader of business says we are in danger, they are doing so for altruistic reasons to make people think, or they are under the boss’s riding instructions to “hose the market down” – BUT – when those statements are not attached with an additional explanation like – you still can buy a home only have a buffer for interests rate increases, then are those well meaning “expert” comments all that helpful?

Especially when all they usually hose down are the inexperienced homebuyers like the Youngies, who are nervous, in need of permanent housing and are already up against it.

If you believe in demand and supply, then possibly our Inner Melbourne market IS NOT DANGEROUS and we are in nothing more than a strong market.

Which brings us back to the young people in our society.

The YOUNG PEOPLE’s housing issue, in our opinion, should be addressed – it will not go away by osmosis AND it is UNFAIR.

Which brings us back to young people and their superannuation funds.

THIS COULD BE A BLOODY GOOD IDEA to LEVEL UP THE PLAYING FIELD for not us oldies, but for young people.

Young people don’t need special treatment; they just need a releveling of a very unlevel and UNFAIR playing field.

I will repeat – with my tax advantages as a 57-year-old tax payer I can go to an Inner Melbourne auction for $1 million and it cost me $20,000 of my income to buy it – YET for a young homebuyer it costs them $80,000 of their income to buy that same home, then that is UNFAIR.

As well, my deposit can come from the increase in my current home value for which I have done little – except make a few smart decisions over the last few decades – before many young people were born.

That possibly is unfair (but maybe not). My point – a young person’s deposit is so, so much harder to get – SUPER could help.

Overseas skilled migration and overseas investors. With tax and other structural advantages, Xiou Lin from Beijing or Peter Pepper from the US, can buy that same Australian $1 million home with a myriad of interest rate and currency advantages over a local young homebuyer.

And please financial planners, bankers and so on – please don’t start telling us that young people’s money is better tied up in one of your funds, rather than good land content, near rail with a workable floor plan.

Please don’t do that without declaring your conflicts as well AND showing us the stats that actually evidences that theory may have a scintilla of historical truth.

Young people, young Australians of all cultural backgrounds and religions are being pushed out of our society by housing STRUCTURAL UNFAIRNESS such as negative gearing, skilled migration policies, overseas investment policies and restricted infrastructure spending.

We as older people have resided over a Tax and Immigration system, with the unintended consequence of making the homebuying market very UNFAIR for YOUNG PEOPLE.

It’s not a guilt trip, I don’t feel bad, I just think we should try and level it up a bit and MAYBE SUPER (under controlled circumstances and with due regard to other issues, such as the current industry) could do that.

The current media blast on how bad an idea it is to try and help young people, because it may already add to a strong housing market is a valid point BUT total baloney in the overall scheme of things for young people.

I’m no rocket scientist and therefore I don’t know if the SUPERANNUATION IDEA will work for sure, but it seems logical and worth a try.

This and other measures should be tried or Inner Melbourne may well become a desert of walking frames, grumpy old farts, unoccupied housing and NO YOUNG PEOPLE in a few decades.

Hawthorn, Toorak and Brighton could be just one big nursing home in 2035.

TRY the SUPERANNUATION IDEA and don’t make it too hard for young people to access it.

Please Young People, Daniel Andrews, Matthew Guy, Malcolm Turnbull and Bill Shorten – GIVE THE SUPER IDEA SOME SERIOUS CONSIDERATION – it seems to makes sense in giving young people a chance to get back on the playing field, with their biggest challenge – a deposit.

Apologies about being on a high horse and I’m not wedded to the SUPER IDEA, nor am I the author of the idea (cheers to Mr Morrison and Mr Alexander and others) – I just think it’s a bloody good idea worth being positive over and worth exploring for young people AND we oldies need to recognise that the current system is unfair for Youngies – and that may not be in our best interests in a decade or so.

BALANCE and a FAIR GO.

Dear Mr Keating,

You sir, are a great man and I read your three points about young people and super deposits.

I’m genuinely listening, you are more experienced in these matters than I.

1) Yes the input of young people with a “Super Deposit”, will increase house prices further, as did negative gearing and skilled immigration and overseas investment. However is that of interest to young people who are currently excluded from the housing market.

Mr Keating, how do I explain to young people that the share market can rise and fall as well and by putting more and more Young People’s money into the sharemarket, there may also be a danger in overheating that market?

2) I think the welfare of the financial services industry is important – but is that an issue of relevance to young people, who have no home. Isn’t that a matter for APRA and the Reserve Bank and themselves – surely they could manage around this?

3) The point that I need your help on Mr Keating is:

Will a young person be better off with their “deposit” in a super fund or their own home?

Financially – Will the compounding of a Super Fund be better for young people, than the compounding of an Inner Melbourne home?

Emotionally – Is it better to be bringing up a family in safe, secure housing for 30 years without moving every second or third year for a family’s emotional stability – or have a bit extra in your Super Fund.

The Maths – now and in 30 years – using 30 years ago as a guide.

An Inner Melbourne home in 1987 cost $160,000 (double Melbourne’s median REIV).

This 1987 asset would have been secured with a $32,000 (20%) deposit, which the young person took from their Super Fund.

That Inner Melbourne home is now worth $1,500,000 (double Melbourne’s Median REIV) plus whatever else the young person saved in Super.

Alternatively the young person who lives in rented accommodation (if they didn’t use their Super) would now be paying $35,000 year in rent – as opposed to $10,000 in bank interest and rates (assuming no paying off of mortgage) on their 1987 bought home.

However they would have had an extra $32,000 compounding in Super from 1987.

I acknowledge there are some gearing issues above – I am looking at the practical, rather than the theory.

What would have happened to that young person’s $32,000 in Super from 1987?

Can any financial services company or you Mr Keating, show young people that an ASX Linked Super Fund (1800 – 2200 points in 1987) and (5000 – 6000 points in 2017) with dividends and accumulation – BUT less Super Fund fees – would have got the wealth of the young person to anywhere near what they would have had, by owning a home with that $32,000.

I’m serious – I’m no expert in the sharemarket, so maybe all those dividends after Super Fund fees would have put a young person in a better position, than owning an Inner Melbourne home.

I can’t see it – but I am open in my mind and I genuinely want to see young people helped.

Thank you Mr Keating, still the best negotiator I’ve ever listened to – I seriously miss your fire and brimstone and I respect your contribution.

Footnote: We are getting more and more entries in for the James Money Bin Competition. It is still running for Young Homebuyers (and potential Young Homebuyers). We are giving away $1,000 to 5 winners (4 to go). For details, terms and conditions please click here.